In today’s interconnected world, global economic trends impact personal wealth management more than ever before. From inflation and market volatility to geopolitical shifts and interest rate changes, individuals must adapt their wealth management strategies to safeguard their financial future. In this article, we will explore five key ways global economic trends impact personal wealth management and provide actionable steps to protect and grow your wealth in an increasingly unpredictable economy.

1. Inflation and Its Effect on Personal Wealth

One of the most significant ways global economic trends impact personal wealth management is through inflation. When inflation rises, the purchasing power of money decreases, meaning your wealth can erode if not managed properly. Here’s how inflation can affect your wealth:

- Reduced Purchasing Power: High inflation reduces the value of savings, making it harder to maintain your current lifestyle without adjusting spending habits.

- Asset Prices: Inflation often leads to rising asset prices, including real estate and commodities, which can be both a risk and an opportunity for wealth management.

- Investment Strategies: To mitigate the impact of inflation, individuals should diversify their investment portfolio with assets that tend to outperform during inflationary periods, such as stocks, real estate, and inflation-protected bonds.

By understanding how inflation as part of global economic trends impacts personal wealth management, individuals can adjust their strategies to preserve their wealth over time.

2. Market Volatility and Portfolio Management

Another critical factor in how global economic trends impact personal wealth management is market volatility. Economic uncertainties, geopolitical tensions, and changing trade policies can lead to significant fluctuations in financial markets. Here’s what you need to know:

- Stock Market Fluctuations: Global events can lead to sudden drops or spikes in stock prices, affecting investment portfolios and retirement plans.

- Risk Tolerance: Wealth management strategies should be tailored to an individual’s risk tolerance, particularly during times of increased volatility. Diversifying across various asset classes can help mitigate risks.

- Rebalancing Your Portfolio: Regularly reviewing and rebalancing your portfolio is essential to ensure it aligns with your financial goals amidst changing global market conditions.

To navigate how global economic trends impact personal wealth management, it’s essential to remain vigilant, stay informed, and adjust your portfolio as needed.

3. Geopolitical Events and Currency Fluctuations

Geopolitical events, such as trade wars, sanctions, or conflicts, have a profound impact on global economies and can directly influence currency exchange rates. Here’s how these factors can affect your wealth:

- Currency Depreciation: When geopolitical instability causes a currency to depreciate, the value of your international investments may decrease.

- Hedging Against Currency Risk: If you have international investments or hold foreign currencies, it’s vital to use strategies like currency hedging to minimize the impact of unfavorable exchange rate movements.

- Global Investment Opportunities: While geopolitical events can pose risks, they can also present opportunities to invest in markets that may benefit from shifts in global economic power.

Understanding the role of geopolitical events in how global economic trends impact personal wealth management can help you protect your wealth against currency fluctuations and capitalize on new opportunities.

4. Interest Rate Changes and Debt Management

Interest rates are another important aspect of how global economic trends impact personal wealth management. Central banks around the world adjust interest rates to control inflation and stimulate economic growth. Here’s how interest rate changes affect your finances:

- Borrowing Costs: When interest rates rise, borrowing becomes more expensive, which can affect mortgage rates, personal loans, and credit card debt. Managing debt efficiently becomes crucial in such times.

- Savings and Investment Returns: Higher interest rates can benefit savers through increased returns on savings accounts, CDs, and bonds. On the other hand, low interest rates encourage investments in equities and real estate for higher returns.

- Refinancing Opportunities: In periods of low interest rates, refinancing existing debt at a lower rate can free up cash flow and reduce overall financial burden.

By understanding how interest rate fluctuations as part of global economic trends impact personal wealth management, individuals can make informed decisions on borrowing, saving, and investing.

5. Technological Innovation and Its Influence on Wealth Management

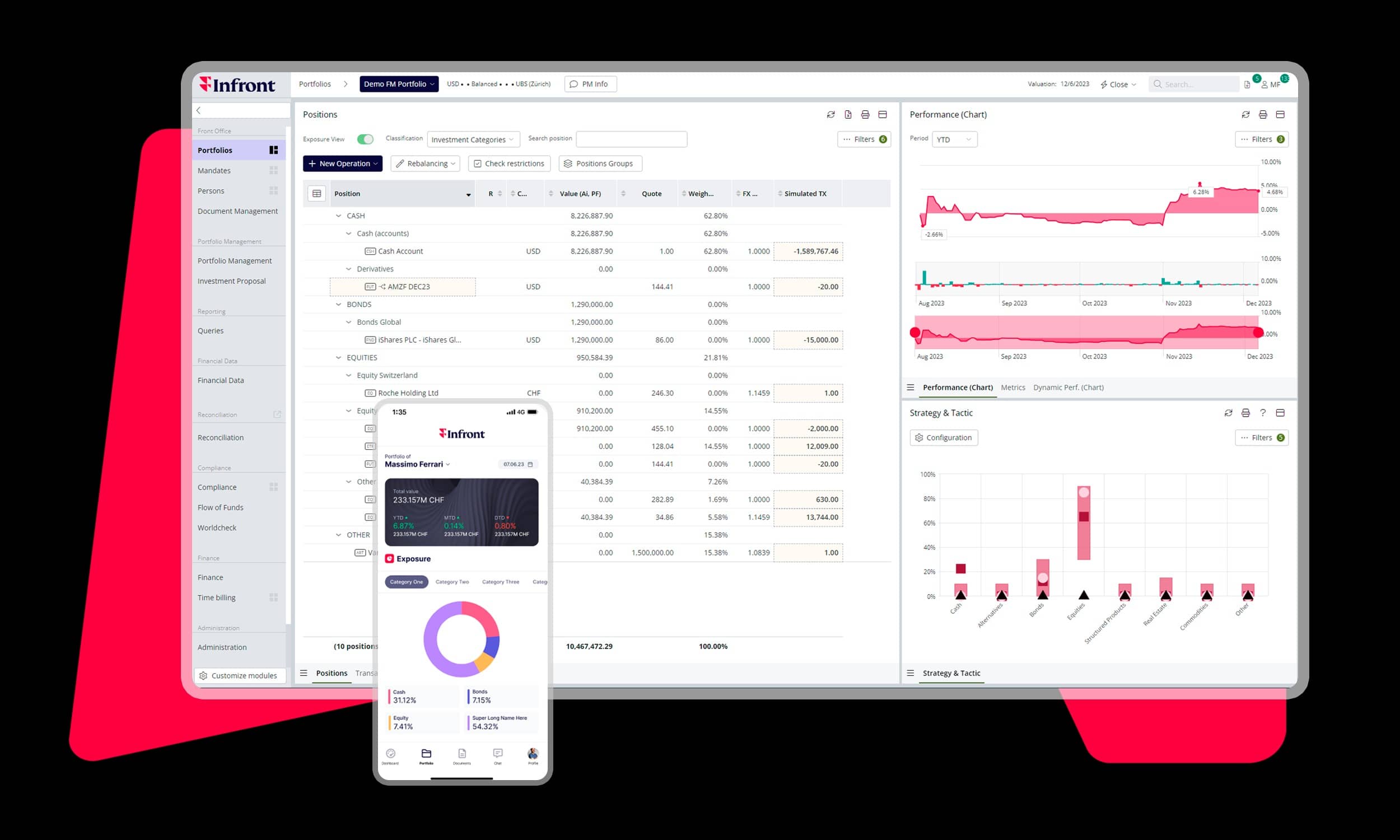

While traditional economic factors like inflation, market volatility, and interest rates are critical, technological innovation is also playing an increasingly important role in how global economic trends impact personal wealth management. Here’s why:

- Digital Assets and Cryptocurrencies: The rise of digital currencies and blockchain technology is revolutionizing the financial landscape, offering new investment opportunities and risks.

- Automated Wealth Management Tools: Robo-advisors and algorithm-based platforms provide affordable and accessible wealth management solutions, helping individuals optimize their investments.

- Cybersecurity Concerns: As more financial transactions move online, the risk of cyber-attacks increases. Protecting personal wealth from cybersecurity threats is now an essential aspect of wealth management.

As technology continues to evolve, staying updated on how innovation as part of global economic trends impacts personal wealth management can provide you with the tools and strategies needed to stay ahead of the curve.

- Top 7 Wealth Management Strategies for Entrepreneurs: How to Achieve Growth

- The Role of Technology in Modern Wealth Management

Conclusion

Global economic trends impact personal wealth management in various ways, from inflation and interest rates to market volatility and technological advancements. By understanding these trends and taking proactive steps, you can protect and grow your wealth even in times of uncertainty. Whether it’s adjusting your investment portfolio, managing debt more effectively, or exploring new opportunities in digital assets, staying informed about global economic trends is essential for successful wealth management.