In today’s unpredictable economic environment, ensuring your wealth lasts for generations is more important than ever. Building a long-term financial plan for wealth preservation can help protect your assets, manage risks, and secure financial stability for your future. Whether you’re preparing for retirement, estate planning, or simply looking to safeguard your hard-earned wealth, a comprehensive strategy is essential. In this article, we’ll guide you through the seven critical steps to develop a robust long-term financial plan for wealth preservation.

1. Define Your Financial Goals

The first step in creating a long-term financial plan for wealth preservation is to define your financial goals. Knowing exactly what you want to achieve with your wealth is crucial to developing a strategy that aligns with your objectives. Start by asking yourself these key questions:

- What are your short-term and long-term financial goals?

- Are you planning for retirement, a child’s education, or buying a second home?

- How much risk are you willing to take with your investments?

By clearly outlining your goals, you’ll have a foundation to build a long-term financial plan for wealth preservation that suits your needs.

2. Create a Budget and Track Expenses

A long-term financial plan for wealth preservation requires a detailed understanding of your income and expenses. Developing a budget is a powerful tool that helps you manage your current lifestyle while saving for the future. Here’s how to approach it:

- Track Your Spending: Use financial apps or spreadsheets to monitor where your money goes each month.

- Identify Areas to Cut Back: Once you have a clear picture of your expenses, identify unnecessary costs or areas where you can reduce spending.

- Allocate Funds for Savings and Investments: Make sure a portion of your monthly income is allocated to long-term savings and investments that contribute to your wealth preservation goals.

By controlling your spending habits, you’ll create more opportunities to invest in your future, which is a cornerstone of a long-term financial plan for wealth preservation.

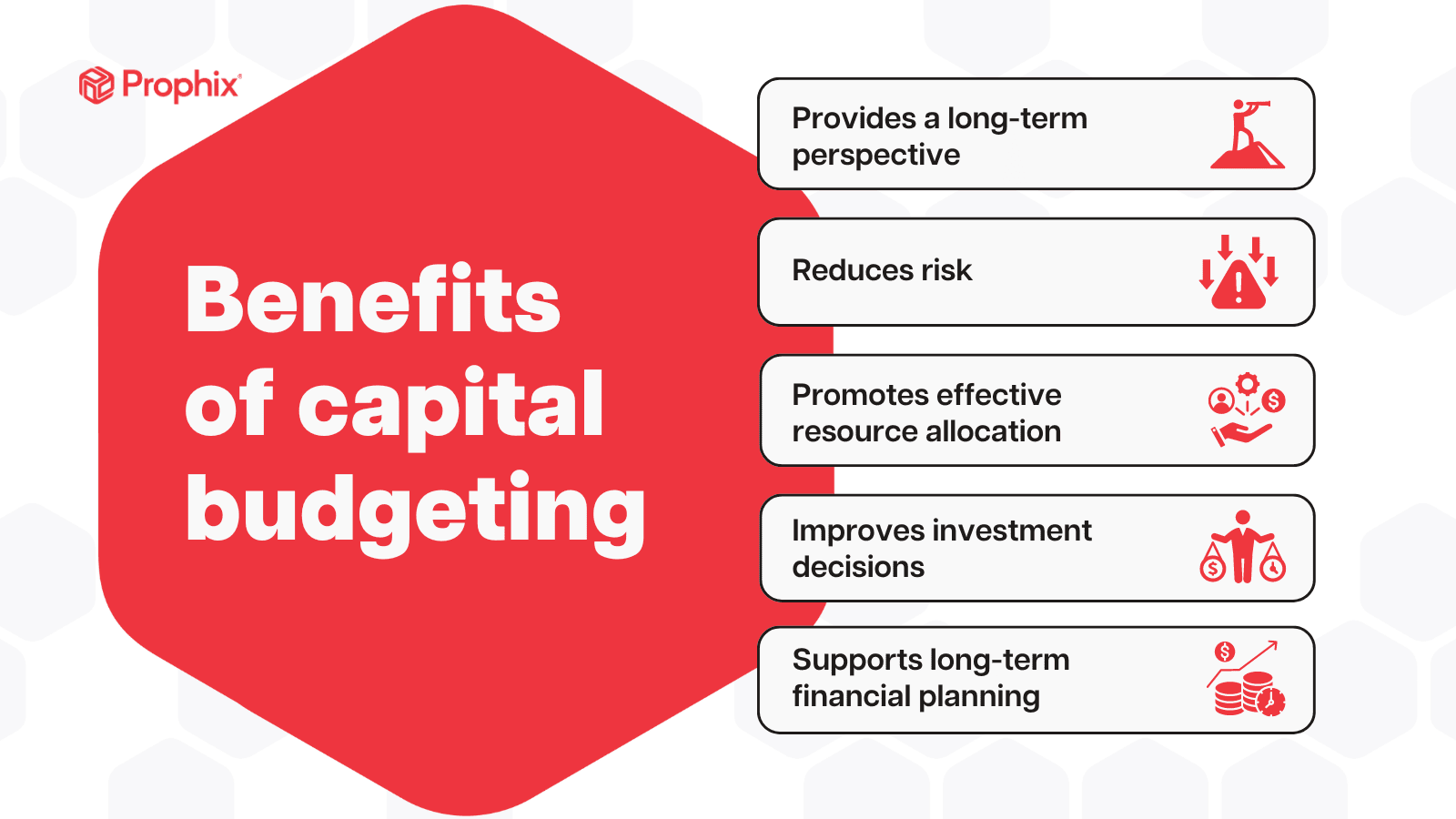

3. Diversify Your Investment Portfolio

One of the most critical steps in a long-term financial plan for wealth preservation is diversifying your investment portfolio. Diversification helps mitigate risk by spreading your investments across different asset classes, such as:

- Stocks: Provide potential for high returns but come with greater risk.

- Bonds: Offer lower risk and steady income but may yield lower returns.

- Real Estate: A tangible asset that can appreciate in value over time and generate passive income.

- Commodities: Investments in gold, silver, and other tangible goods can provide a hedge against inflation.

A well-diversified portfolio reduces your risk exposure, making it easier to sustain and grow your wealth over the long term.

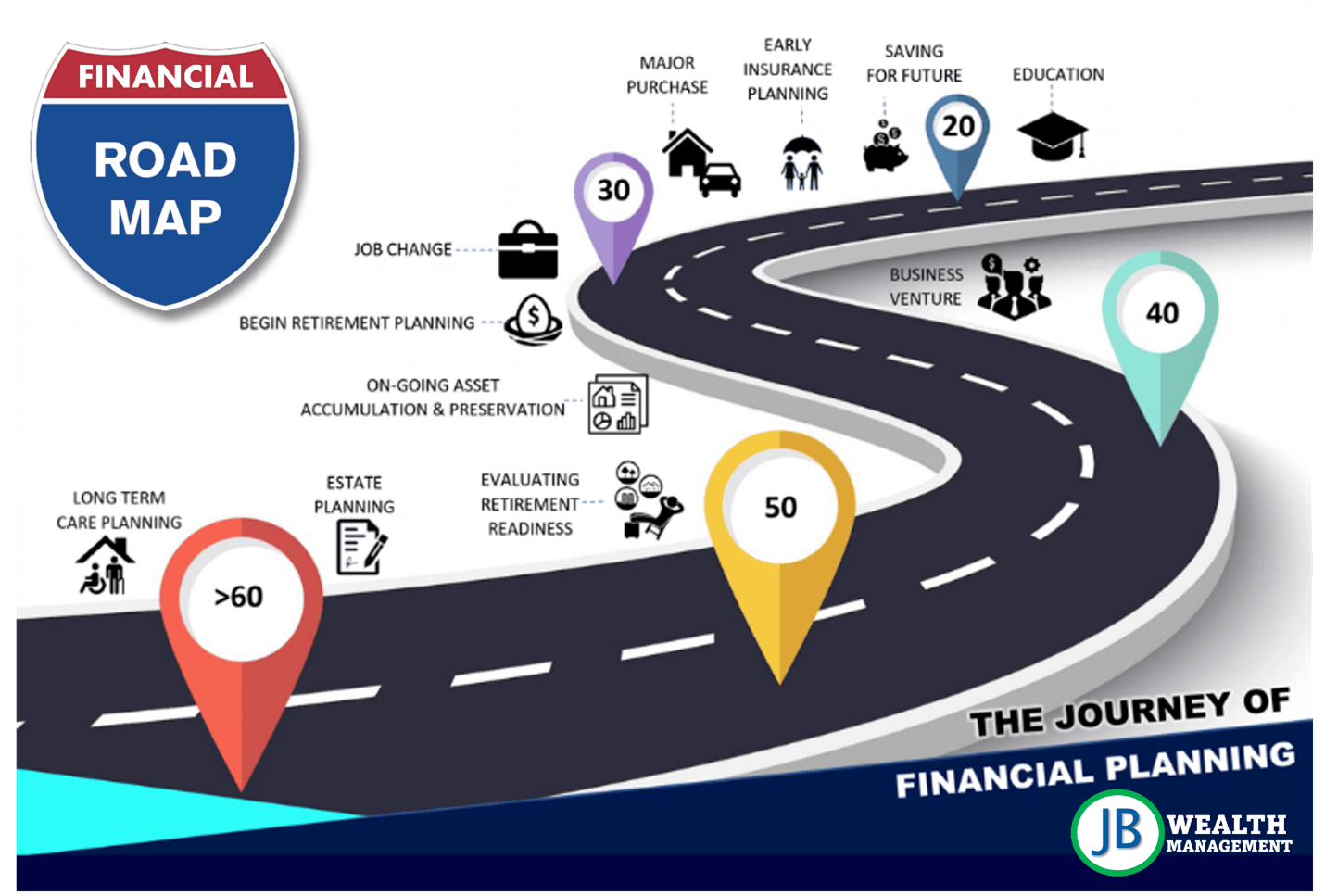

4. Plan for Retirement Early

One of the primary objectives of any long-term financial plan for wealth preservation is to ensure a comfortable retirement. The earlier you start planning for retirement, the more time your assets have to grow. Here are key considerations:

- Maximize Contributions to Retirement Accounts: Contribute to tax-advantaged accounts like 401(k)s or IRAs.

- Employer Matching: Take full advantage of any employer contributions to retirement accounts.

- Diversify Retirement Investments: Include a mix of stocks, bonds, and other low-risk assets in your retirement portfolio.

Starting early and being consistent in your contributions will help solidify your long-term financial plan for wealth preservation.

5. Implement Tax-Efficient Strategies

Effective tax planning is essential for wealth preservation. High taxes can erode your wealth, making it crucial to develop tax-efficient strategies. Here’s how to do it:

- Utilize Tax-Deferred Accounts: Maximize contributions to retirement and investment accounts that defer taxes until withdrawal.

- Capitalize on Tax Credits: Look for tax credits and deductions, such as those for charitable contributions or energy-efficient home improvements.

- Hire a Tax Advisor: A professional can help you identify ways to minimize taxes and keep more of your wealth.

A tax-efficient strategy is a vital part of any long-term financial plan for wealth preservation, as it ensures more of your assets remain intact.

6. Establish an Estate Plan

An estate plan is crucial for ensuring that your wealth is passed on to future generations in the most efficient way possible. Without a solid estate plan, your assets may be subject to legal battles, probate, and high taxes. Consider these steps:

- Draft a Will: Clearly outline how your assets should be distributed.

- Set Up Trusts: Trusts can help reduce estate taxes and protect assets from legal claims.

- Assign Power of Attorney: Designate someone to make financial and medical decisions on your behalf if you’re unable to do so.

Estate planning ensures that your long-term financial plan for wealth preservation is carried out according to your wishes and benefits your heirs.

7. Regularly Review and Update Your Financial Plan

A long-term financial plan for wealth preservation is not static. Life changes such as marriage, the birth of a child, or a change in career can significantly impact your financial situation. Therefore, it’s important to:

- Conduct Annual Reviews: Assess your investments, savings, and financial goals at least once a year.

- Adjust for Life Changes: Update your plan to reflect any significant life events.

- Rebalance Your Portfolio: Ensure that your asset allocation remains in line with your financial goals and risk tolerance.

Regular reviews will keep your long-term financial plan for wealth preservation on track and allow for adjustments when necessary.

Conclusion

Building a long-term financial plan for wealth preservation is essential for protecting your wealth and ensuring financial security for you and your family. By following these seven steps—defining your financial goals, creating a budget, diversifying your investments, planning for retirement, implementing tax-efficient strategies, establishing an estate plan, and regularly reviewing your financial plan—you can secure your financial future. Start planning today, and you’ll be well on your way to preserving your wealth for the long term.