In today’s fast-paced financial world, having a solid wealth management strategy is more important than ever. Whether you’re just starting to accumulate wealth or you’re already well-established, 2024 presents unique opportunities and challenges in managing your assets effectively. This article will walk you through the top 10 wealth management strategies for 2024, helping you make informed decisions and protect your financial future.

Wealth management is more than just investing; it’s about ensuring that your assets are working for you, growing over time, and providing security for your future. From diversified investment portfolios to tax-efficient planning, these wealth management strategies for 2024 will help guide your financial decisions.

1. Diversify Your Investment Portfolio

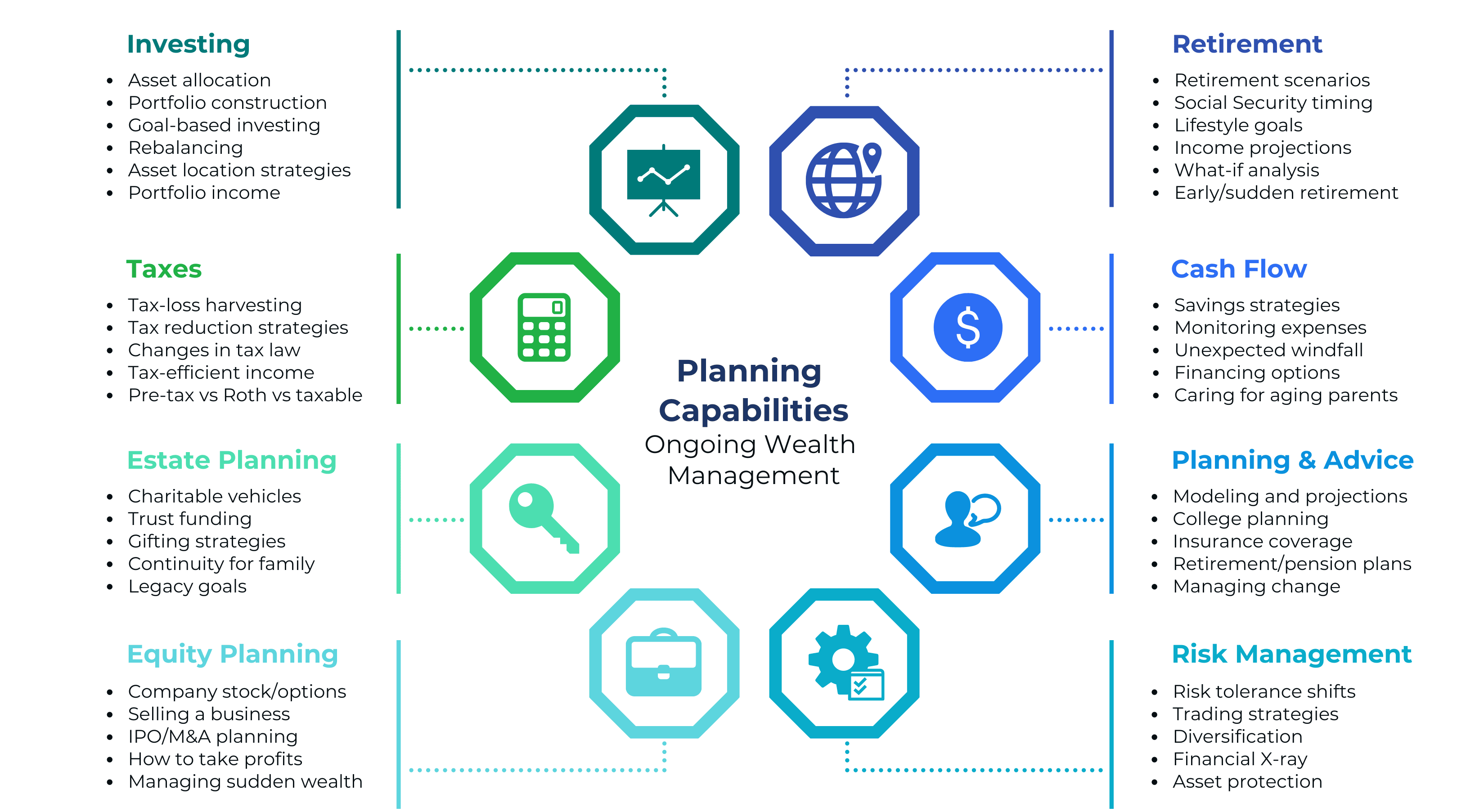

The first step in any successful wealth management strategy is diversification. By spreading your investments across various asset classes—such as stocks, bonds, real estate, and commodities—you can reduce risk and improve potential returns. For 2024, consider diversifying globally as well, tapping into international markets with growth potential.

- Why Diversify: It reduces the risk of losing money if one investment underperforms.

- How to Diversify: Invest in different industries, regions, and asset types.

2. Focus on Long-Term Investment

One of the key wealth management strategies for 2024 is long-term investing. While the stock market may fluctuate in the short term, historical data shows that long-term investments in quality assets tend to appreciate over time.

- Benefits of Long-Term Investing: Reduces the impact of market volatility and allows compound interest to work in your favor.

- Key Assets for Long-Term Growth: Consider stocks, real estate, and retirement funds.

3. Tax-Efficient Investment Planning

Tax efficiency is a crucial aspect of wealth management. To maximize your returns, you need to structure your investments in a way that minimizes your tax liabilities.

- Tax-Deferred Accounts: Utilize tax-deferred accounts like 401(k)s or IRAs to grow your investments without paying taxes on them until withdrawal.

- Capital Gains Management: Be mindful of capital gains taxes and consider holding investments longer to qualify for lower long-term capital gains rates.

4. Estate Planning and Asset Protection

Estate planning ensures that your wealth is passed on to your heirs with minimal tax consequences and legal hurdles. For 2024, robust estate planning should be part of any comprehensive wealth management strategy.

- Create a Will and Trust: Ensure your assets are distributed according to your wishes.

- Consider Gifting Strategies: Reduce your estate’s taxable value by gifting assets during your lifetime.

5. Leverage Technology for Financial Management

In 2024, technology plays an increasingly important role in managing wealth. From robo-advisors to AI-driven financial tools, leveraging technology can help streamline your financial planning.

- Use Financial Apps: Track spending, monitor investments, and get financial advice through various platforms.

- Consider Robo-Advisors: For those who want a hands-off approach, robo-advisors provide automated investment management at a lower cost than traditional advisors.

6. Consider Alternative Investments

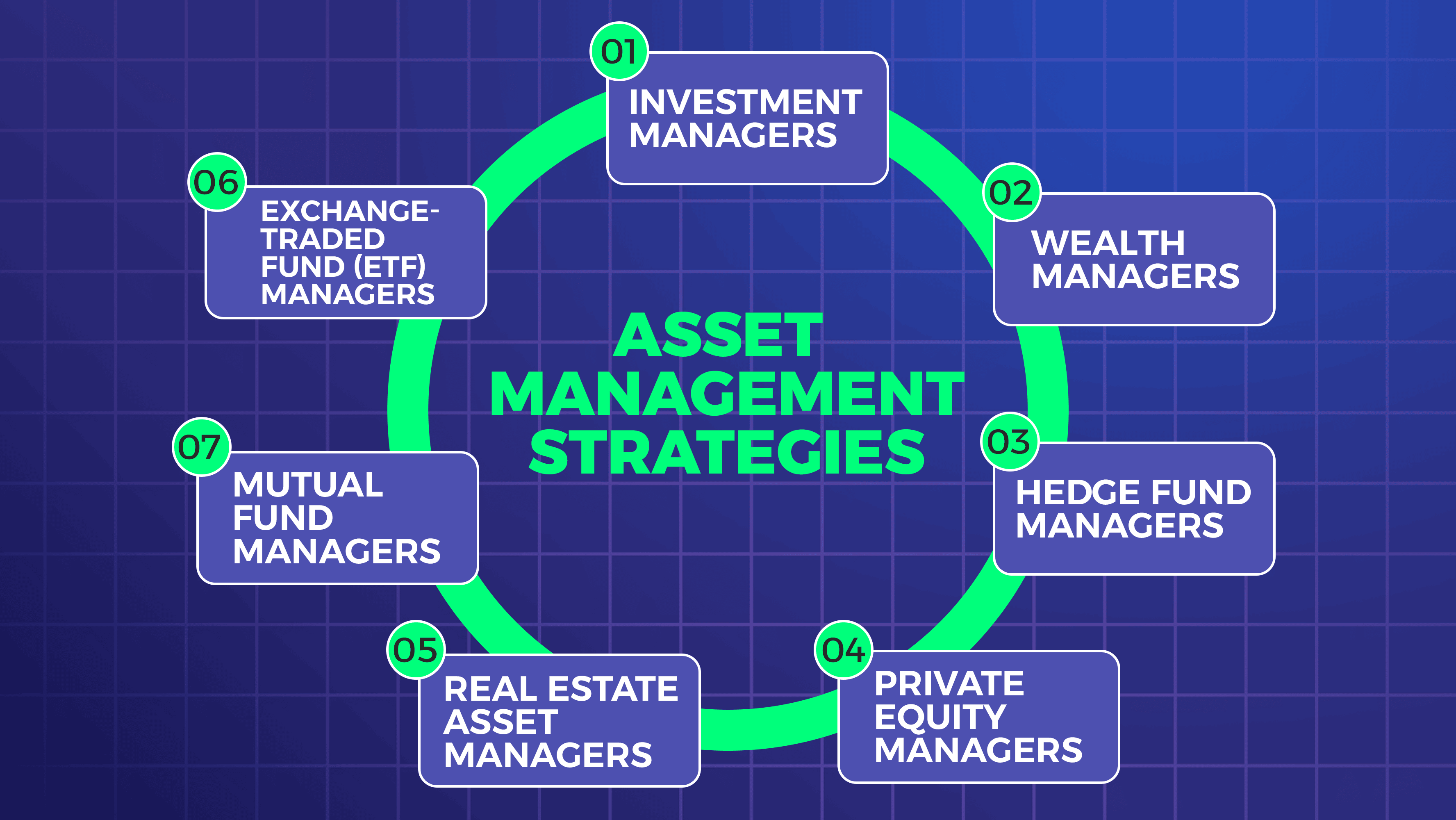

As traditional investments like stocks and bonds become increasingly volatile, alternative investments are becoming a more attractive option in 2024. This includes investing in assets such as private equity, hedge funds, cryptocurrencies, and collectibles.

- Why Consider Alternatives: They offer opportunities for high returns and help in diversifying risk.

- Popular Alternatives for 2024: Cryptocurrencies, peer-to-peer lending, and art.

7. Maximize Retirement Contributions

Retirement planning remains a cornerstone of wealth management strategies. Make sure you are maximizing your contributions to retirement accounts such as IRAs and 401(k)s.

- Take Advantage of Employer Matching: If your employer offers a matching contribution, ensure you contribute enough to get the full match.

- Increase Contributions Each Year: As your income grows, increase your retirement contributions to build a substantial nest egg.

8. Review and Rebalance Your Portfolio Regularly

The financial markets are constantly changing, and so should your investment portfolio. One of the top wealth management strategies is regularly reviewing and rebalancing your portfolio to ensure it aligns with your goals and risk tolerance.

- Why Rebalance: It helps maintain your desired asset allocation and reduces risk.

- How Often to Rebalance: Consider reviewing your portfolio at least once a year or when there are major market movements.

9. Optimize Your Debt Management

Debt is a part of life for many, but managing it wisely is critical to protecting your wealth. For 2024, focus on strategies that reduce interest payments and accelerate debt payoff.

- Debt Snowball vs. Debt Avalanche: Use the snowball method (paying off smaller debts first) or the avalanche method (focusing on high-interest debt first).

- Consider Refinancing: With interest rates still relatively low, refinancing existing loans can free up cash flow and reduce the cost of borrowing.

10. Stay Informed and Adjust Your Strategies

The world of finance is constantly evolving. Staying informed about market trends, economic changes, and new financial products is vital to successfully managing your wealth.

- Stay Updated on Market Trends: Follow financial news and consult with a financial advisor to make informed decisions.

- Adjust Your Strategy as Needed: Be flexible and adjust your wealth management strategy based on your life goals and market conditions.

Conclusion

Implementing these top 10 wealth management strategies for 2024 can help you grow your wealth, protect your assets, and secure your financial future. From diversified investing and tax-efficient planning to estate management and leveraging technology, each of these strategies offers a way to optimize your wealth management approach.

Whether you’re just starting on your wealth-building journey or looking to refine your existing financial plan, these proven strategies can give you the tools and insights you need to succeed. Remember, the key to effective wealth management is regular review and adjustment based on your personal financial goals and market conditions.